The 7 Best Budgeting Planners To Control Your Spending

Let’s face it, managing your personal finances can be boring. Keeping your money organized can be less than exciting and sometimes a little scary if you don’t know what you’re doing.

That’s where a budget planner or budget book comes in. A budget or financial planner can be a fun way to help you track your income and expenses, create a spending plan, and stay on top of managing your money in an organized way.

If you prefer to document and budget your money with pen and paper rather than on your electronic device through an app, then this list is for you.

Whether you’re just starting your financial journey or looking for a new way to manage your monthly budget, I’ve rounded up 7 of the best budget planners to get you started.

What Are the Best Budgeting Planners?

A good budget planner should be able to track your expenses, track your savings, and allow you to set goals and create a financial plan. On top of tracking your monthly budget and monthly spending, a good budget planner should be personalized and durable.

The following budget planners include all of these things and more to make budget planning and tracking expenses easy and fun.

While there may not be such a thing as a perfect monthly budget book or budget planner, you’re sure to find something that fits your financial goals.

Here are 7 of the best budget planners.

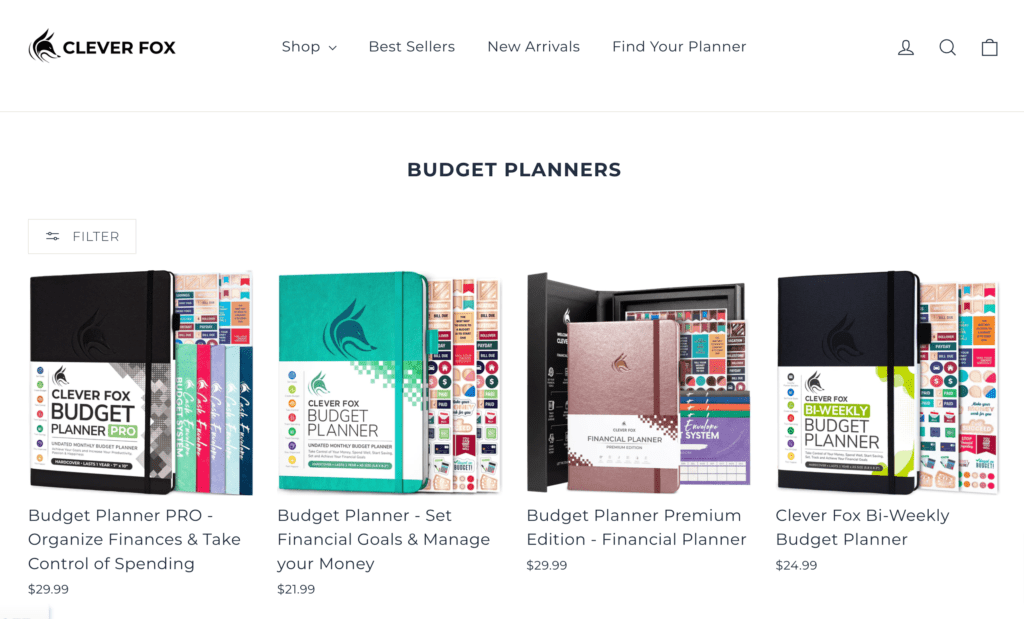

1. Clever Fox Budget Planner

The Clever Fox Budget Planner is one of the best budget planners out there with thousands of purchases on Amazon.

This budget planner book is designed to aid you in managing your finances and keep you on track to achieve your goals.

This budget planner is both practical and visually appealing, with a sturdy hardcover and high-quality paper that is enjoyable to write on.

The planner features a variety of budgeting tools, including the tracking of income and expenses, debt payments, and savings.

One of the main features of Clever Fox’s budget planners is its customization capabilities. You can choose from three cover designs and three color schemes to personalize the planner to your preference.

This planner also includes customizable monthly and weekly budgeting pages, which enable you to tailor the planner depending on your financial situation.

In addition to its budgeting tools, Clever Fox Budget Planners include numerous helpful features, such as a yearly overview, a section for setting goals, and space for taking notes.

To get the maximum use out of your new budget planner Clever Fox also includes access to a video course that provides you with practical financial advice, budgeting tips, and guidance on using your planner effectively so you can use it to its full potential.

Overall, the Clever Fox Budget Planner is an excellent resource for anyone seeking to manage their finances effectively.

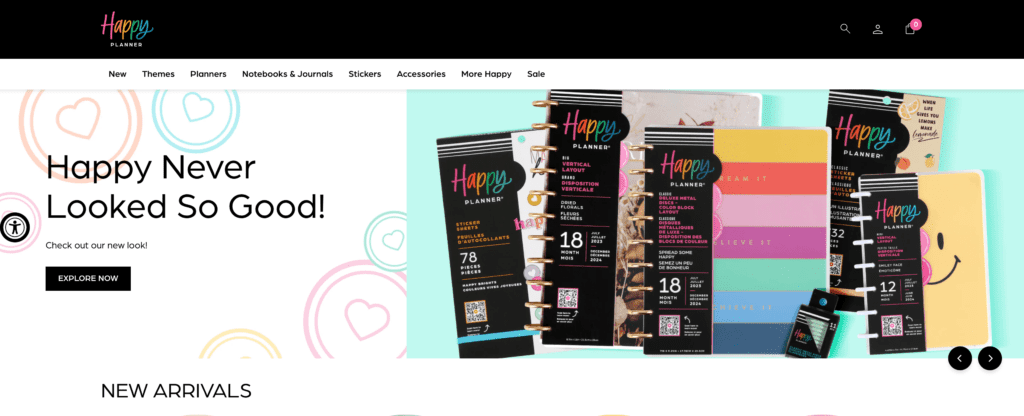

2. The Happy Planner

The Happy Planner budgeting planner is an all-inclusive financial tool that can assist with allowing you to keep track of where your money is going.

This planner’s durable hardcover and attractive design make it an ideal choice for everyday use especially if you need to travel.

The Happy Planner is quite useful in offering a variety of budgeting tools, such as monthly budget and weekly budget pages, expense tracking, and debt payment tracking.

This great budget planner includes a space for setting financial goals, allowing folks to monitor their progress to better achieve them.

Additionally, the Happy Planner features customizable options that enable users to tailor the planner to their specific needs and preferences.

This budget planner’s diverse cover designs and layouts provide ample room for personalization making it unique for your individual preferences.

This budgeting planner also includes several features, including a calendar overview, a notes section, and a list of financial advice and recommendations to give you a roadmap to success.

It includes stickers and decorative elements making it a fun and creative way to manage finances so you’re less likely to lose interest and keep making a steady effort at goal setting.

3. Blue Sky Monthly Planner

The Blue Sky Monthly Planner is a stylish and practical tool designed to help you stay on track with your finances and monthly expenses.

This budget planner features a solidly built cover and durable paper, making it strong enough to handle heavy daily use.

One of the standout features of the Blue Sky Monthly Planner is its simplicity. The planner offers a straightforward monthly calendar, allowing you to quickly and easily plan your schedules and tasks for the month ahead.

The planner also includes a notes section and a handy monthly calendar reference for easy navigation.

Like many of the other budget planners on this list, the customization options are another great feature of this monthly planner.

You can choose from a range of cover designs based on your preferences and can also choose various sizes, from compact to large, to suit your needs.

The Blue Sky Monthly Planner is quite stylish and features a range of fun and trendy cover designs, making it a fashionable accessory for anyone looking to stay organized.

This budgeting planner’s style combined with its versatility, customization, and user-friendly layout makes it a solid choice.

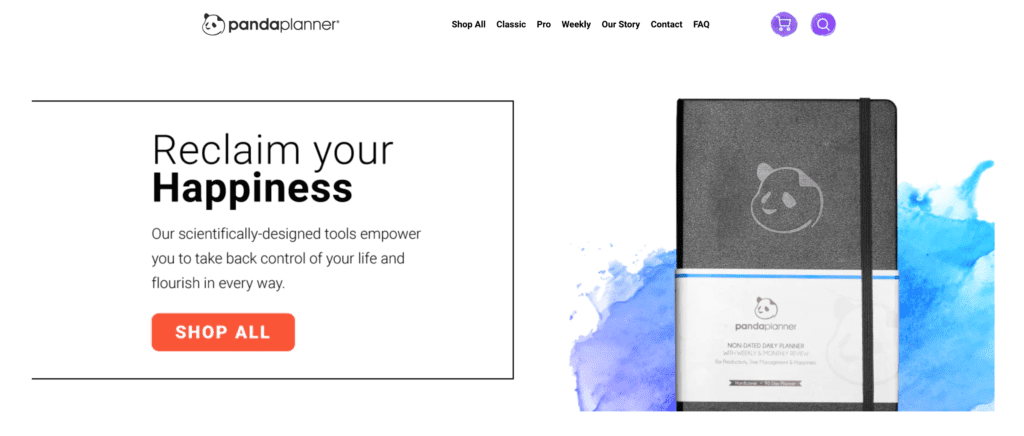

4. Panda Planner

The Panda Planner is a comprehensive tool designed to help you manage your time, productivity, and overall well-being.

The hardcover and quality grade paper make it durable for heavy use so you don’t have to worry about shuffling it around during transit.

With an emphasis on positivity and mindfulness, the Panda Planner can keep you grounded with the right mindset.

It includes sections for daily, weekly, and monthly planning, as well as space for setting and tracking goals, practicing gratitude, and reflecting on personal growth.

This budget planner book is versatile in that it includes various tools, such as a habit tracker, a time-block scheduler, and a priority list, making it easy for you to manage your tasks and stay on top of your schedules.

In addition to the above features, the Panda Planner also includes inspirational quotes and prompts for self-reflection and promoting positivity along your journey to financial success.

The Panda Planner is an excellent option to not only keep your budget in check but your mindset as well.

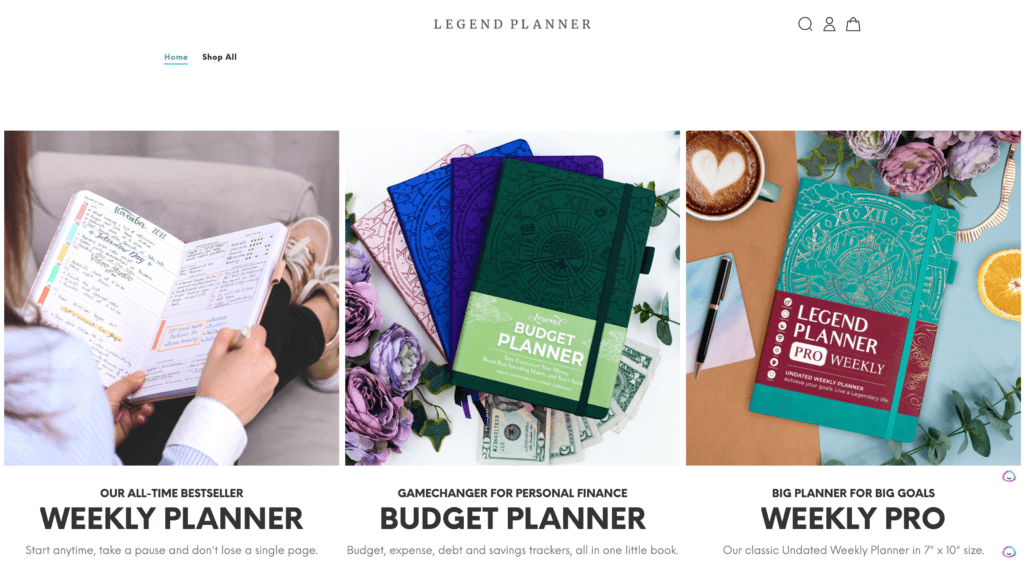

5. The Legend Budget Planner

The Legend budget planner is sleek. Not only is it tough enough to withstand heavy use, but it is also one of the more professional-looking and best budget planner books out there.

One of the best things about the Legend Budget Planner is its abundance of tools.

It includes monthly and weekly budget pages, a space to track income and expenses, and a debt payment tracker. This makes it super easy to stay on track with your financial goals.

This budget planner has a professional look as well as a plethora of options, including a notes section and a list of financial tips and tricks, giving you even more options to choose from.

However, the Legend Budget Planner isn’t just about finances. The accessibility to helpful resources like personal and professional development, sections for goal setting, habit tracking, and time management make this planner one of a kind.

Personally, I think the Legend Budget Planner stands out for anyone who wants something that’s comprehensive with customization options and additional resources for developing your financial well-being.

Between the sturdy design, diverse features, and helpful resources this budget planner is truly an all-in-one solution.

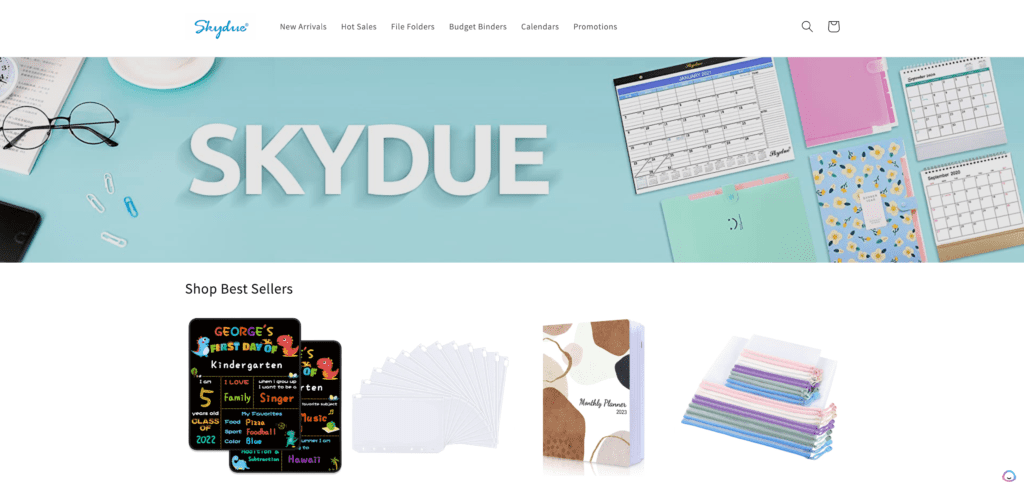

6. Skydue Budget Binder

What truly sets the Skydue Budget Planner apart is its straightforward approach to budgeting.

This is an excellent budget planner that is simple to use with a straightforward monthly layout.

You can easily plan your expenses, set savings goals, and track your progress throughout the year.

It also includes a handy section for recording bills and expenses, which helps you stay organized and avoid nasty surprises.

Like many other budget planners on the list, the Skydue Budget Planner allows you to customize your options. You can choose from a range of cover designs to your liking and they are also available in various sizes depending on how you will be using them.

This budget planner helps track your spending habits, allows you to set goals, and even has a space for journaling and reflecting on your progress.

Skydue Budget Planners are one of the better options for folks looking for customization, a sturdy design, and a straightforward layout.

7. Go Girl Budget Planner

The GoGirl budget planner not only helps you manage your finances but is specifically made by women for women.

This budget planner notebook promotes a healthy mindset while working toward your money-saving goals.

This budget planner can be an excellent choice for busy moms and professionals alike.

One of the best things about the GoGirl Budget Planner is how user-friendly it is. You can easily track income and expenses while monitoring your personal progress.

Inspirational quotes and affirmations are key features of the GoGirl budget planner so you can stay positive and on track. With an emphasis on self-improvement, you are more likely to stay consistent throughout the year.

Customization options are available with this planner and it also includes a built-in pocket for storing bills and receipts, cash envelopes, and other documents, so you can easily keep tabs on expenses.

What Are Budgeting Planners?

A budget planner is a tool used to help individuals or households manage their finances and create a monthly spending plan for daily expenses.

They provide a structured format for debt tracking and spending habits to inform you where your money is going and what items or services it’s actually going to.

In today’s digital age, there are a lot of smartphone apps that can make this process quite easy. Some of us however are “old school” and prefer the old-fashioned pen-and-paper method.

I personally prefer a physical product when it comes to budget and financial planning. It’s something I can pick up and reference without staring at a screen.

The best budget planners feature such things as expense tracking, budgeting worksheets monthly calendars, and goal-setting prompts.

The ultimate goal of using a budget planner is to better understand your financial situation and develop healthy financial habits.

FAQ

What Features Should I Look For in a Budget Planner?

Depending on how you will be using it, the most common features you should look for in a budget planner are:

- Size

- Durability

- Affordability

- Ease of use

- Design

- Customization options

- Organization

Why Should I Use a Budget Planner?

In short, budget planners save money. A budget planner is a must for anyone who is serious about taking control of their financial well-being. Much like a road map, budget organizers help you create a solid plan on how to get to your financial destination successfully and in the shortest time possible.

Can I Customize My Budget Planner?

Yes, many budget planners allow you to customize it to fit your personal finance needs and goals. Only choose budget planners that have customization options as everyone is different and what works for one person may not work for others.

Can a Budget Planner Help Me Save Money?

Yes, budget planners help you save more money! If you know how your money is being spent from your monthly income, a budget planner can help you with debt tracking so you can cut out unnecessary expenses, control your monthly budget, manage your monthly bills, set realistic financial goals together, and help you eliminate mindless spending habits.

Conclusion

Finding the best budget planner for your personal finance needs can be a valuable tool in helping you take control of your finances and create a monthly budget.

There are a variety of options on the market with different features, sizes, and designs depending on your needs.

The key is to choose a planner that fits your specific financial goals, whether that be tracking your income, eliminating unnecessary expenses, keeping tabs on bills and receipts, increasing savings, or reducing debt.

A perfect budget planner should be durable, organized, easy to use, and customizable to your own monthly budget goals and specific needs.

While there may not be a best budget planner notebook, by investing in one that works for you, you’ll be on your way to achieving your financial goals for a brighter financial future.