DIY Credit Repair – 9 Easy Steps To Skyrocket Your Credit

I remember looking for an apartment years ago when I had to relocate for work.

My credit score wasn’t horrendous, but bad enough to where I could only qualify for places that looked like they belonged in skid row. Yikes!

I became determined to find ways to incorporate DIY credit repair so I wouldn’t find myself in this position again.

The good news is that I was able to get that 800 credit score with a little bit of calculated effort and some basic know-how.

In this guide, I’ll cover everything you need to know about DIY credit repair, from understanding your credit report and your credit scores to what the three credit bureaus look for in your creditworthiness.

DIY Credit Repair Steps

Let’s get to the 9 easy DIY steps to improving your credit score.

1. Check Your Credit Reports

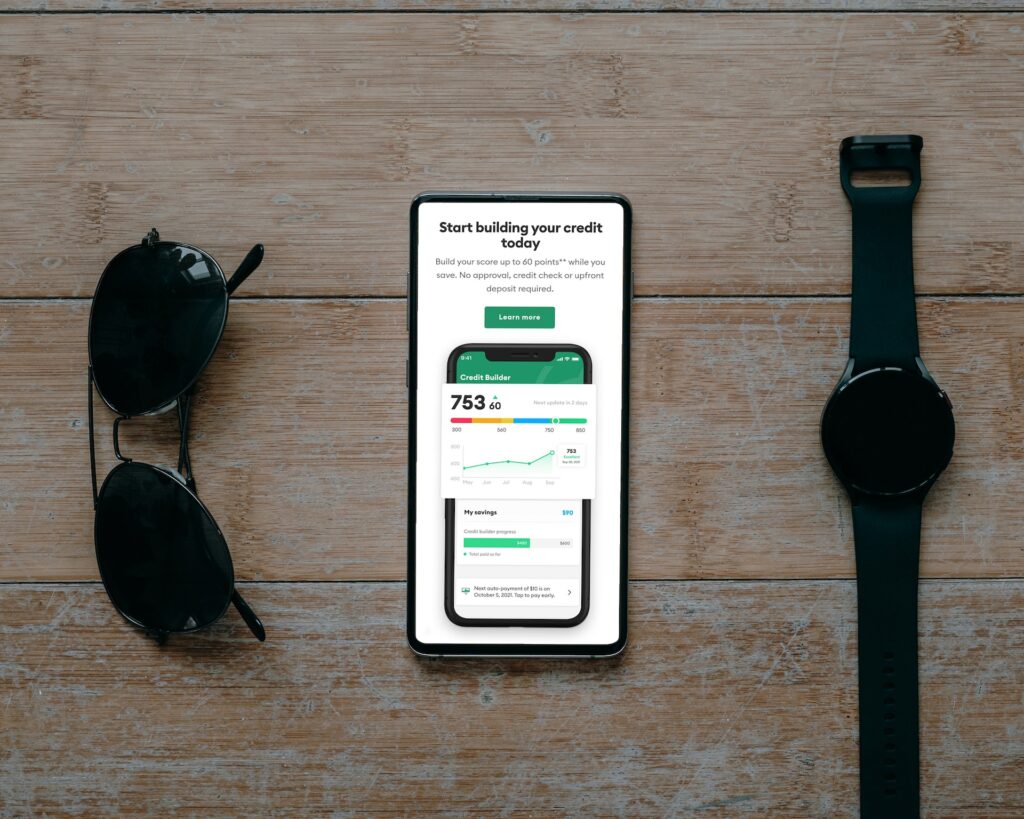

This is your first task and has become much more convenient to do with numerous free credit reports and apps out there.

You can also request copies of a full free credit report from your credit reporting agency at annualcreditreport.com. Here you will able to get copies of your full credit report from the top 3 credit agencies (Experian, Equifax, and Transunion.)

I personally use the Credit Karma app as it’s updated daily and gives you tips and advice for increasing and maintaining your credit score based on your individual situation.

From here you will want to take a deeper dive into any late payments, outstanding debts, and payment history to dispute incorrect information if need be.

I was terrified of checking my credit report for the first time, but just know that no matter what scary things could come up on it there that this is the first step in getting your credit back on track.

Plus, you can make sure that if there are any errors holding you back you can get them resolved as soon as possible.

2. Pay Bills On Time

You should already be implementing this one, but if not, make sure you are paying your bills on time every time. More importantly, focus on paying your past due accounts first then once you are current with your balances, it will be much easier to keep your payments on time and in check.

On-time payments are one of the most important factors in raising your credit score and once you can tackle this one head on then you will be well on your way to fixing your bleak credit score.

If you are terrible at remembering the due dates for your bills, many companies have an opt-in where you can receive text reminders when your due date is approaching. If this isn’t an option, take the time to add these dates to your calendar on your smartphone.

Another option is to sign up for automatic withdrawal. Many companies have this feature now and some will even discount your monthly payment just for enrolling!

Once you start making on-time payments you will start creating a regular habit and soon you will become more aware of pending due dates and make sure they are covered when the time comes. After all, repetition is the mother of all skills!

3. Pay Down Your Debt

Once you get a starting point of where you are at with your debt, you can start implementing a strategy to tackle it.

Much of the information out there on building good credit scores, will tell you to start paying your highest balances first.

While I agree with this one, there are a couple of issues I personally came across while building my own credit.

First of all, you may have a high balance on an account, but if it is during a promotional period with deferred interest rates (ex. no interest if paid in full within a certain time period), it would be better to tackle your high-interest accounts first while you’re not getting charged interest on your promotional accounts.

However, make sure you pay off your deferred interest accounts within the promotional period or else you will be on the hook for the total back interest amount during the whole duration of your loan!

Interest rates are ridiculous and were my main reason for not getting ahead quicker. Getting high-interest accounts tackled first will keep you from throwing away money that isn’t going toward your total balance anyway.

The second thing I encountered was that I had a large credit card balance on one account and several smaller credit card balances owed on the other accounts. If I spent most of the time tackling the bigger account, there were more accounts to manage over a longer period of time which can lead to missed payments if you’re not careful.

I personally found it easier to make at least my minimum payments on my larger account while significantly paying down or even paying off my several smaller credit card balances first.

Once those were knocked out it was much easier to maintain the larger remaining account that was left open without juggling multiple accounts all at once.

Plus, I was able to dramatically increase my payment amount toward my larger account after my smaller ones were taken care of. This seemed to really make a big difference not only for my credit score health but making it much easier to maintain my remaining debt and pay it all off quicker.

To recap this section, paying your larger account balances first is smart, but only in certain circumstances. At the end of the day do what’s best for you and your situation.

4. Keep Your Credit Utilization Low

The more credit you are using and rotating through, the harder it is to pay it down and build your credit. While it’s actually healthy to use some credit, you want to be careful about how much credit you are using and how it will look on your credit report.

Keeping your credit utilization under 30% is recommended meaning you are using no more than 30% of the available credit on your account.

For example, if you have $1,000 in available credit on an account, you will want to keep your borrowing at $300 or less at any given time.

This makes you look like you are a responsible borrower to the three credit reporting agencies and also keeps you from overstretching your ability to keep up with your outstanding debts. A win-win!

Now for the weird part. You can only build your credit by using it. Huh? Yep, credit bureaus will actually punish your credit score if you aren’t using your credit accounts. To an extent, they want you to have some kind of credit card debt.

Not only that but if you don’t have enough open credit accounts, it could be even harder to build your credit score.

In order to keep your credit score growing, you will want to use some credit as it shows these credit bureaus that you can responsibly use it. The key is to only borrow what you can pay back.

The best way to approach this is to only charge enough on your credit card during the month to be able to pay off the full balance by the due date.

This not only avoids interest charges but keeps your credit revolving which leads to your score increasing!

5. Keep Your Accounts Open

Keeping your credit accounts open can actually impact your credit score in a positive way.

One of the main factors that make up your credit score is the length of your credit history. The longer you’ve had credit accounts open, the better it looks to lenders because it shows that you have a track record of managing your credit responsibly.

Closing a credit account can also negatively affect your credit utilization ratio.

As mentioned before your credit utilization ratio is the amount of credit you’re using compared to your total available credit.

If you close a credit account, your total available credit decreases, which could cause your credit utilization ratio to go up. This could hurt your credit score, in the long run, causing you to possibly pay a higher interest rate or not qualify for certain credit accounts.

Another reason to keep your credit accounts open is that they can save you money overall.

For example, if you have a credit card with a high credit limit and no annual fee, keeping that account open could be beneficial.

This is because having a high credit limit can help keep your credit utilization ratio low, which in turn can help your credit score.

Additionally, having a credit card with no annual fee means you won’t have to pay an annual fee to keep the account open. This can add a positive effect on your credit score without costing you anything extra in fees.

Of course, there are some situations where it may make sense to close a credit account.

If the account has an annual fee that you don’t want to pay, it may be worth considering closing the account.

Additionally, if you’re trying to simplify your finances and don’t want to deal with multiple credit accounts, closing some of them could make sense depending on your situation.

6. Apply For a Secured Credit Card

If you’ve gotten yourself to a good financial place with some money in the bank but are having trouble qualifying for credit cards due to a low credit score or a limited credit history, then a secured credit card is a way to get your credit back on track.

Secured credit cards require a security deposit which is usually equal to the credit limit of the card. For example, if you put down a $500 deposit, you’ll have a credit limit of $500.

The reason why a secured credit card is a good option for building or rebuilding credit is that it works just like a regular credit card.

You make purchases and payments just like you would with a regular credit card, and the activity is reported to the three credit bureaus.

If you make your payments on time and keep your credit utilization low, you can build a positive credit history over time.

One thing to keep in mind is that not all secured credit cards are created equal. Some may come with high fees or interest rates, so it’s important to do your research to find the best option for you before applying.

Look for a card with reasonable fees and interest rates, and make sure the card issuer reports your activity to all three credit bureaus.

Another thing to consider is how much of a security deposit you’ll need to put down. The amount can vary depending on the issuer and how creditworthy you are.

If you can afford to put down a larger deposit, you may be able to get a higher credit limit and potentially improve your credit utilization ratio. Again, be careful to keep your credit utilization low so you don’t stretch yourself too thin.

7. Apply For Different Types of Credit Accounts

You may have a great track record with your credit accounts, but if you don’t have a variety of different types of credit accounts, then it could be keeping you from reaching that 800 credit score you’ve been working so hard for.

I personally had an issue with this because I had paid off my auto loans and the bank closed my accounts.

I also didn’t have a mortgage either, so lacking these two account types on my credit report was actually slowing my progress at growing my credit score.

Just to be clear I’m not saying that if you don’t have a mortgage or an active auto loan you should go out and buy a house and a new vehicle just to improve your credit score by a few points.

Just know that when you have a variety of accounts, it’s actually an added benefit as it shows the credit bureaus that you are paying multiple types of accounts in a responsible manner.

Only open credit accounts that you know you can handle based on your current financial situation and your long-term goals.

I was still able to reach an 800+ credit score over time, but it just took a little longer than it would have if I had a variety of account types in my credit history, so don’t think it’s not possible!

8. Avoid Opening Several Credit Accounts at Once

This can have a couple of drawbacks. Opening several credit accounts in a short time period can cause multiple hard inquiries.

A hard inquiry is when a lender pulls information from your credit report to check your creditworthiness. This can cause your credit score to temporarily drop.

As I mentioned it’s temporary and as long as you are making your payments responsibly, your credit score will usually jump back up after a short time.

Opening several accounts at once can also trigger that you are seeking financial assistance and could be at higher risk of not making payments on time in the future.

This can be a little frustrating, because you may have every intention of keeping your payment history up to date, but just like any borrowing situation, you are still a risk in the lender’s eyes which could lead to you paying higher interest rates.

Lastly, if you are new to building your credit, then you will want to keep your number of active credit accounts to a minimum to avoid getting overwhelmed by juggling multiple credit accounts at the same time.

9. Request a Credit Limit Increase

Ok, so you’ve been making your payments on time and steadily growing your credit score proving that you are credit-worthy.

That’s great! However, there is another way you can grow it even faster.

If you have a specific credit account or accounts that you have been on track with such as a revolving line of credit, then you can request a credit limit increase from the credit card issuer.

In many cases, if you have been successful with your payment history and have kept your credit utilization at a healthy level then you have a great chance of getting an increase in available credit.

This can be an instant win since you will immediately increase your borrowing amount and reduce your credit utilization.

As mentioned previously, keeping your credit utilization low will have a positive impact on your credit report, and with an increase in available credit, your utilization will automatically drop.

I’ve actually had a couple of credit card issuers automatically increase my credit limit without me even reaching out!

At the end of the day don’t be afraid to ask for a credit increase. After all, you’ve worked hard at keeping your payment history timely and your expenses in check.

What Is DIY Credit Repair?

DIY credit repair refers to the process of improving your credit score on your own, without the help of professional credit repair companies.

In essence, you take charge of your own credit repair journey to identify and address any errors or negative information on your credit report.

Here is a list of a few benefits of DIY credit repair.

- More cost-effective than hiring a professional credit repair service.

- Taking ownership of your own credit repair journey.

- A better understanding of your credit history, credit reports, and what factors are affecting your credit scores.

It’s important to note that DIY credit repair can be time-consuming and sometimes challenging. You’ll need to have an understanding of how to dispute errors on your credit report, know where you need to make needed changes and work to improve your credit habits over time.

If you’re considering DIY credit repair, it’s important to have realistic expectations and to be patient with the process.

While it may take some time and effort, you will reap the benefits of a high credit score and set your financial future straight sooner than later.

Conclusion

DIY credit repair can be a more lucrative and cost-effective option than hiring a professional credit repair company.

I personally found it liberating to feel like I was taking control of growing my credit score myself.

However, it is important to have realistic expectations and to do your research before getting started with doing your own credit repair.

Make sure you understand credit laws and regulations and be patient with the process. It may take several months or even years depending on your situation to see significant improvements in your credit score.

Like anything in life, stay determined, stay consistent, and be sure to enjoy the journey knowing that you will soon be reaping the benefits to a better financial future.